Most college students look forward to summer break and a reprieve from the classroom, but few have the resources to take the “summer off” from one of their most difficult challenges: paying for their education.

A postsecondary education can be expensive, but it is an investment worth making. Whether a student attends Community College of Allegheny County, learns a trade or receives a four-year degree from the University of Pittsburgh, education is the key to a better future.

Fortunately, the Pennsylvania Higher Education Assistance Agency (PHEAA), in cooperation with the Pennsylvania Department of Community & Economic Development and state Treasurer Joseph Torsella, have launched the PA Forward Student Loan Program.

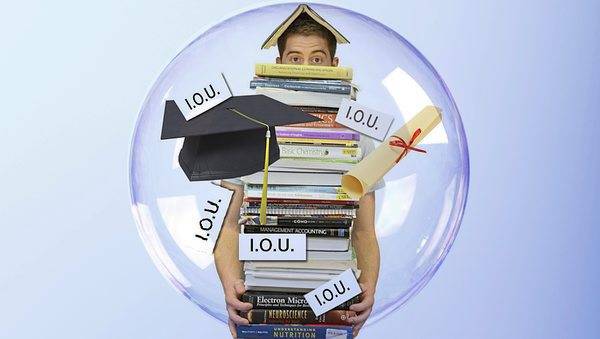

PA Forward is a new suite of affordable private student loan programs created to help families cover the full cost of higher education, without getting buried in unnecessary debt.

Students and families can benefit from this homegrown program more than ever. According to a 2012 Lumina Foundation study, Americans with associate degrees earn 51% more annually than high school graduates with no college degree. Bachelor’s degree holders earn 134% more annually. Those who attain degrees are more likely to find jobs, have health insurance, vote in elections and even live longer.

Currently, more than 46% of Pennsylvanians have obtained their postsecondary education, including high-quality certificate programs and degrees. However, it is estimated that 60% of Pennsylvanians will need to obtain a postsecondary education by 2025 to meet Pennsylvania’s future workforce needs.

Additionally, low-income, first-generation students must often overcome difficult barriers when attaining their degree. These barriers can be even higher for people of color.

Clearly, the rising cost of college means that private student loans are increasingly necessary after students exhaust grants, scholarships, campus-based aid and low-cost federal student loans.

Under PA Forward, PHEAA makes borrower-friendly private student loans to Pennsylvania students at competitively low rates and with superior repayment benefits. Students can borrow up to the total cost of attendance with no application or origination fees, flexible repayment options, interest rate reductions for successful graduation, additional rate reductions for enrolling in automatic debt and no late fees during repayment.

Students pursuing a degree, diploma or certificate for completing certain trade training programs can also qualify for a loan.

The PA Forward Student Loan Program will make borrowing more affordable. However, students must also understand that the key to borrowing wisely is to do so only when it’s necessary. Again, low-cost, federal student loans should be the first option after all eligibility for gift aid is exhausted.

After careful consideration of the costs and options for financing college, and the many long-term positive returns on a college degree, student loans are increasingly the only way forward for many students. When this is the case, we are working to make sure students have the tools and resources to make smart choices, including PHEAA’s new PA Forward Student Loan Program.