A developer planning to build more than 260 homes at the former Valley Green Golf & Country Club is gauging if Hempfield Township, Hempfield Area School District and Westmoreland County would approve using a tax diversion program to pay for road improvements.

“This is not a tax break,” said Michael P. Pehur of Duane Morris Government Strategies during a presentation to suggest using tax-increment financing, commonly called a TIF, to pay for the upgrades to Valley Green Road.

“It’s just a diversion to help fund the infrastructure, and that is infrastructure that the township requested. It will benefit not just the site but residents that are passing through that area.”

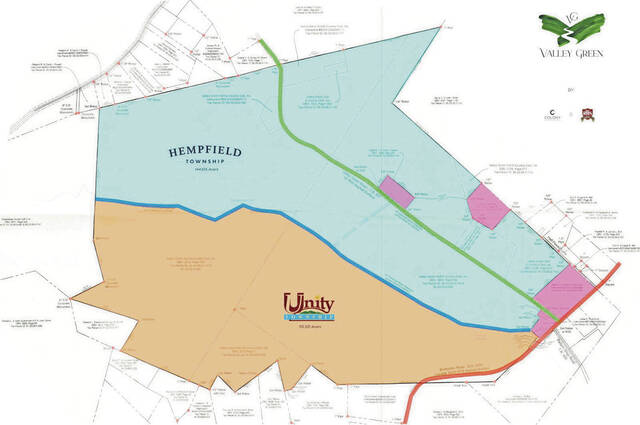

Township supervisors last year granted conditional approval to Valley Green Westmoreland LLC — a partnership between Colony Holding Cos. and Shuster Homes — to develop the first 63 lots at the former 18-hole golf course that closed in 2019. Once fully developed, the plan will contain 261 lots.

Certain improvements — such as installing traffic calming measures and providing site distances for lots on the bend of the road — were a condition of approval.

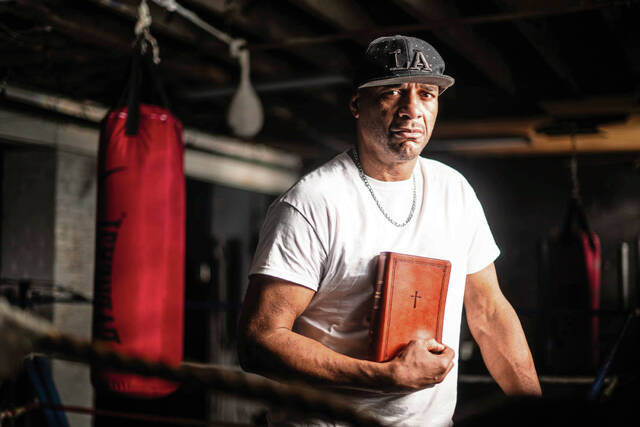

“At the last minute, there was a contingency lobbed on to upgrade the road, which breached this entire discussion. … This hopefully is the tool to get that road improved with a roundabout and traffic control devices that we talked about,” said Don Tarosky Jr., who is owner-partner-developer in Valley Green Westmoreland.

If a TIF district is created, base taxes — or the taxes as they stand today — will continue to go to the township and school district, Pehur said.

The balance between the previous tax assessment and new assessment would go toward paying for infrastructure improvements. The diverted taxes are repaid within a maximum of 20 years.

“That tax base is frozen, the TIF proceeds are utilized to build out the public infrastructure, which allows the project to go forward,” Pehur said. “As the project builds out, the taxes increase over time. A portion of that increment is used to finance the debt service for the upfront infrastructure.”

Officials have 20 years to pay off the TIF, although it could be done before that.

It was not clear how much money the developer could receive for the project if the TIF is approved.

Pehur will meet with the Hempfield school board and the county to gauge their interest, he said. Although 116 acres of the former 260-acre golf course property lies in Unity and is slated for development, that parcel is not included in the TIF proposal.

To create a district, the developer must gain approvals from the township, school board and county. Pehur said two sets of legislative approvals are required, the first being a resolution of intent. The nonbinding agreement authorizes officials to create a TIF plan.

That plan is then drafted with members of a committee, which includes representatives from the three taxing bodies. That plan must be approved by the issuing authority.

After the plan is approved, taxing bodies will decide if they will participate. The final vote would take place at the county level, which would hold a public hearing to discuss the TIF.

After the hearing, the county must wait three weeks before voting.

“The fact that three taxing authorities are going to have to agree on this, it would be my suggestion that you go to the school district, have this presentation with them, and then we’ll either set up a committee with their committee to have a further discussion about it to see what the interest is,” Supervisor Tom Logan said.

If there is interest in creating a TIF district, developers could seek legislative action in October, Pehur said.

“I don’t want to get into this thing and it stall,” Tarosky said. “I don’t think it’s going to, but this helps us get to a point, get the lot prices down, keep it moving. That’s what we want to do.”