A portion of admission fees for large, ticketed events in East Deer will soon go to the municipality.

Commissioners on Thursday adopted a 5% tax on admission fees to large events hosted in the township. The tax becomes effective April 13.

Event coordinators would be responsible for collecting the fees and paying the township. They must also register with the township before events. The tax only applies for events in which admission tickets are sold to more than 500 people.

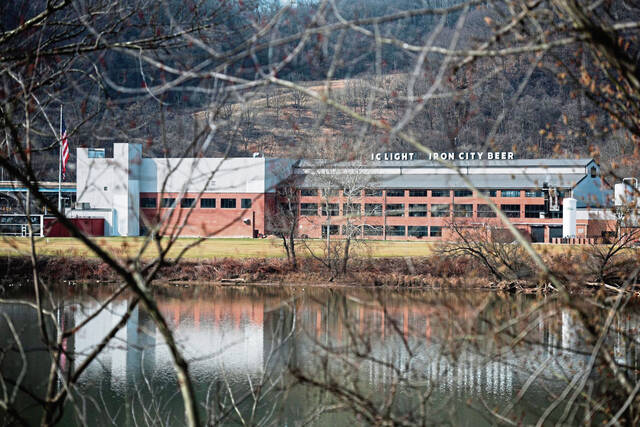

The move comes as events and concerts are gearing up at the Pittsburgh Brewing Co. facility.

A summer concert series at the brewery’s amphitheater kicks off June 29 with a Jimmy Buffett tribute band. Subsequent concerts have yet to be announced. The venue could hold upward of 7,000 people, which led East Deer to pursue the tax, township officials have said.

The township already missed out on potential revenue from the sold-out Oktoberfest on the brewery’s grounds, which attracted more than 800 people. It also will not be able to collect money from Saturday’s St. Patrick’s Day festival that drew more than 2,000 revelers.

In comparison, East Deer’s population in 2020 was 1,490, according to the U.S. Census Bureau.

When the ordinance was first proposed, Commissioners Chairman Tony Taliani said it would be advantageous for the township to pursue the tax because of the strain large events would have on the municipality’s services, such as its roads and police force.

Brewery spokespeople did not return requests for comment Friday.

Most municipalities with event venues have an amusement tax, including West Mifflin, home of Kennywood, and the City of Erie. East Deer officials have said their amusement tax ordinance features elements of rules in place by those two communities.

In West Mifflin, a 5% amusement tax is imposed on admission fees and the tax is built into the price of a ticket. That tax went into effect in the mid-1970s.

In Erie, a 3% amusement tax is imposed on admission fees to any amusement within the city. The vendor then pays the tax to the city within 10 days after the end of the event or by the 10th of every month. Erie implemented its ordinance around 2006.