An Allegheny County Common Pleas judge will decide whether a permanently disabled Vietnam veteran ought to be required to pay about $20,000 in back taxes to the Shaler Area School District.

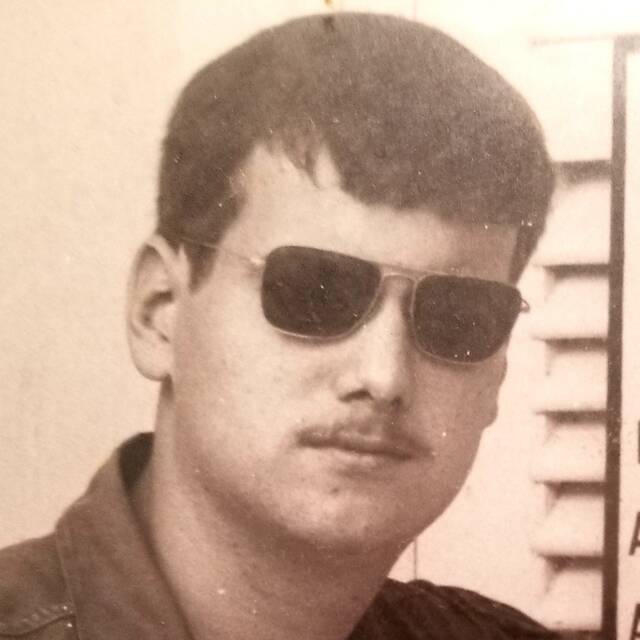

After hearing arguments on the issue Wednesday, Judge Dan Regan said he would issue an order in the case at a later date. He also thanked Robert Reichle, 72, and his attorney John Arch for their military service.

“Obviously, this court and all the citizens of this county are grateful to you and Mr. Reichle for your service,” Regan said.

Regan must decide whether Reichle and his wife, Linda, are required to pay the taxes owed from 2011 through 2017, or if they are exempt because he is a permanently disabled veteran.

The school district filed a tax lien against the couple in 2017, and then filed a notice to sell the couple’s house at sheriff’s sale two years later.

The Reichles, who have lived in the home since 1977, objected and filed their own lawsuit against the school district, arguing that they should be exempt from paying the back taxes.

The case is scheduled for trial in September.

Under the Pennsylvania Constitution, any resident “who served in any war or armed conflict in which the United States was engaged … shall be exempt from the payment of all real property taxes.”

To qualify for the exemption, the person must have been honorably discharged, be 100% disabled and found by the State Veterans Commission to be in financial need of the exemption.

Reichle met all of those requirements and was officially granted the tax exemption in June 2018.

Shaler Area School District argued that the exemption does not apply retroactively, and Reichle was responsible for the back taxes owed.

Attorney Jonathan McAnney, who represented the school district in court on Wednesday, said that Pennsylvania statute says the exemption applies only prospectively for taxes that come due on or after the veteran applies for it.

“The exemption does not apply retroactively,” McAnney said.

He accused the Reichles and their attorney of misrepresenting the law.

Arch said McAnney is ignoring the Constitution.

“It says payment of all real estate taxes. It means ‘all,’ everything,” Arch said. “Mr. McAnney is trying to argue all means some.”

Arch told the judge that the regulation McAnney cited is a nullity because the legislature had no authority to issue something in conflict with the Constitution’s language that said “all” taxes.

Arch argued that the Reichles are in financial need of the exemption, and that had his client been aware of its existence earlier, he would have applied for it earlier.

Reichle was declared 100% disabled in 2008. He served as a combat correspondent for the Stars and Stripes newspaper in the U.S. Army during the Vietnam war. While there, he was exposed to Agent Orange, a tactical herbicide used by the American military to clear leaves and vegetation.

Reichle has heart disease and diabetes, both which can be caused by exposure. He uses a walker and must frequently check his blood sugar.

Reichle and his wife both attended Wednesday’s hearing. He said he is most frustrated by the lack of responsiveness from the Shaler school board, to whom he sent individual letters seeking assistance.

None of the members responded, Reichle said.

“When I came home from Vietnam, no one told me I could be exempt from taxes,” he said.